In the world of numbers, consider this: during the spring of 2010, four seminars on a range of topics in finance drew 70 to 80 percent of the faculty in the Department of Finance and Real Estate in Florida International University’s (FIU) College of Business Administration. Eighty to 90 percent of the department’s PhD students also attended, joined by faculty from University of Miami’s Finance Department and from the corporate world.

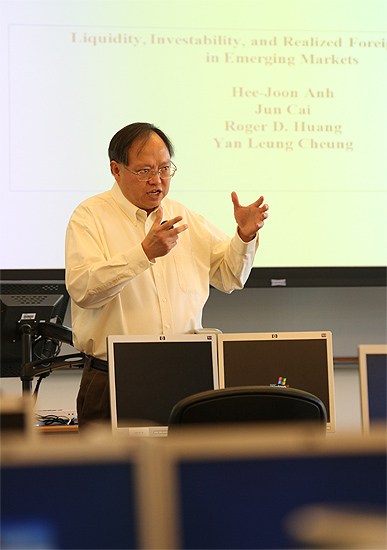

The series kicked off with Roger Huang, professor and associate dean, University of Notre Dame, who spoke on “Liquidity, Investability and Realized Foreign Investment in Emerging Markets.” He argued that the more foreign investment is in a multinational firm the higher its stock liquidity.

Werner DeBondt, professor, DePaul University, discussed “Behavioral Revolution in Finance,” surveying research demonstrating that the investment portfolios of many people were distorted by false beliefs and unreasonable choices, that there was excess volatility in stock and bond prices and that it was possible to profit from investor sentiment by going against the crowd.

Bonnie Van Ness, professor and chair of the Department of Finance, University of Mississippi, and co-editor of the premier journal Finance Review, presented “Aggressive Short Selling and Price Reversals.”

“The research showed that short selling may, occasionally, cause excessive price pressure,” said Suchi Mishra, the department member who organized the series. “Short selling is an extremely hot topic in finance because during the 2008 financial crisis it was banned and later the regulations were modified to prevent predatory short selling.”

The series closed with a talk by Charles Jones, Robert W. Lear Professor of Finance and Economics; chair, Finance and Economics Division, Columbia University; and editor of Journal of Financial Markets, a premier journal. “Shackling Short Sellers: the 2008 Shorting Ban,” offered evidence that conflicted with Van Ness’s. Jones and other researchers followed events when short selling was banned, finding a significant deterioration in market quality for the stocks for which short selling was banned. According to them, short selling eventually improves information in the market and hence improves price efficiency.