US Market

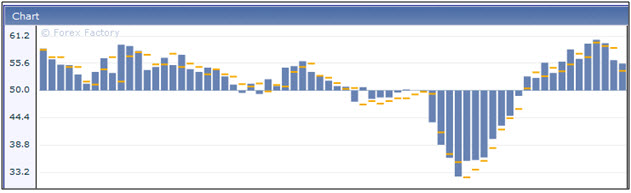

As of Thursday, August 5th, the US equity markets continued in their respective rallies behind mixed economic data and earnings. This week we saw the ISM manufacturing index (Institute for Supply Management, Purchasing Managers’ Index) drop to 55.5 from 56.2, however still higher than the expected level of 54.2. When the index is above 50 it is said to indicates industry expansion, with points below 50 indicating contraction. On Tuesday, pending home sales dropped at a lower rate than last month’s record plunge, being reported at -2.6%, lower than the +0.5% expected.

On Wednesday, the ISM Non-Manufacturing PMI was reported at 54.3 versus 53.2, up from the last monthly report of 53.8. On Thursday, the unemployment claims report was higher than expected, at 479k versus the 456k expected, higher than last week, where 460k reported unemployment.

While reported news was mixed, the markets continued higher, with the S&P 500 index gaining 1.65% for the week as of Thursday. As Friday approaches, many traders and investors alike seem to be fixated on the monthly unemployment report that is due Friday morning before the market open. Many will see this as either a catalyst to continue higher or a reason to lock in the 10%+ gains that the market has given over the past month.

–Alex Tarhini

Toyota’s Recovery

The industry’s most emulated company has recovered from a slump to post $2.2 billion in quarterly profit that ended June 30. This was achieved by aggressive cost-cutting measures and a 27% increase in worldwide sales, especially in the emerging markets. Despite the fact that the global recession had slowed down things along with the ongoing series of safety recalls and the strong yen, Toyota ended the period with revenues of $57.3 billion compared to a $900 million loss over the same three month period which ended June 30, last year. Furthermore, loan defaults saw a huge decline which hence helped to boost profits in Toyota’s North American financial services businesses that accounted for 85% of a $1.27 billion operating profit. The shares of Toyota trading in Tokyo rose 3.4 percent to 3,160 yen, the highest in three weeks.

The company’s manifold of recent sales incentives, including zero percent financing and enhanced safety features have helped them to bring back their loyal customers in spite of the safety recalls. Moreover, Toyota has also been able to receive a boost from the government-backed incentives in most markets for their “green models” like the Prius hybrid.

However, it seems that the yen’s strengthening could disrupt the future outlook. This is because a strong yen or home currency could make their products more expensive abroad and lowering the yen value of their earnings in foreign currency, thus hurting Japanese exporters. The yen has been steadily increasing and hit an eight-month high on Wednesday against the U.S. dollar causing a shift in the currency trades. Also, future earnings could be hurt as government incentives for the hybrid models are nearing expiration in markets such as Japan and the United States. Hence, this surge in sales and revenues may lose its steam unless Toyota calls for an aggressive plan to keep cutting costs and increasing sales worldwide.

–Rowena Zacharia

DIRECTV Second Quarter Results

Shares of the satellite television provider DIRECTV surged 4.6% Thursday morning on solid earnings data resulting from robust growth in Latin America and lower churn rates. A Bloomberg average of 15 sell-side analysts revealed diluted EPS to grow to $.599 from $.40 from a year ago. The company met expectations by delivering an EPS of $.60 per share; despite only meeting expectations, the share price increased robustly on optimism from a series of new products, continued strong Latin American growth, and the approval of an additional $2.0 billion share buyback program. The firm managed to acquire 515,000 net new subscribers this quarter while maintaining a monthly churn rate of 1.51 %. Despite heavy competition from other cable companies, DIRECTV has managed to stabilize customers seeking to leave the company by pursuing an aggressive campaign of offering high-end services like high definition and DVR services to increase customer satisfaction. The satellite company has a 70% penetration rate in providing advanced services to new customers, meaning that DIRECTV is attracting high-end customers that are less likely to leave the company.

Free cash flow declined this period by 30% because of higher interest payments from increased debt balances and higher tax payments resulting from higher pre-tax income. Despite a decrease in this metric, “cash flow before taxes and interest did increase 47% compared to the first six months from higher operating profit before depreciation and amortization.” The executives of the company have acknowledged that the remainder of the year would be more challenging because of higher comparisons and slower Latin American growth. The World Cup resulted in higher demand from Latin America; however, this luxury will not be available for the company in the second quarter.

China Stress Tests

This week Chinese authorities announced that they would be running a series of stress tests on their major Chinese banks. The banks will be asked to calculate scenarios where asset prices drop 50-60%. Chinese authorities seem to be in responding to fears that asset prices have increased to quickly, (real estate prices in particular) and also to fears that Chinese banks might lose liquidity. Earlier this year Chinese regulators began to intervene and slow real estate lending. This came in response to a 68% increase in prices from the previous quarter.

China is the latest in a series of countries to perform stress tests and to worry about the liquidity of their financial sector. Critics of European and American stress tests claim that the tests were designed for banks to pass and for confidence to be restored. However, Chinese authorities seem to be setting an example by designing tests that can actually demonstrate the resilience of their banks. The TAO ETF which tracks Chinese real estate has risen 138% since November 20th, 2008.

–Robert Belsky

Article submitted by: Michael Alfaro, Robert Belsky, Alex Tarhini and Rowena Zacharia of the Capital Markets Lab (CML). To learn more about the Capital Markets Lab please visit https://business.fiu.edu/capital-markets-lab/.