Equity Spotlight: Apple (NASDAQ: AAPL)

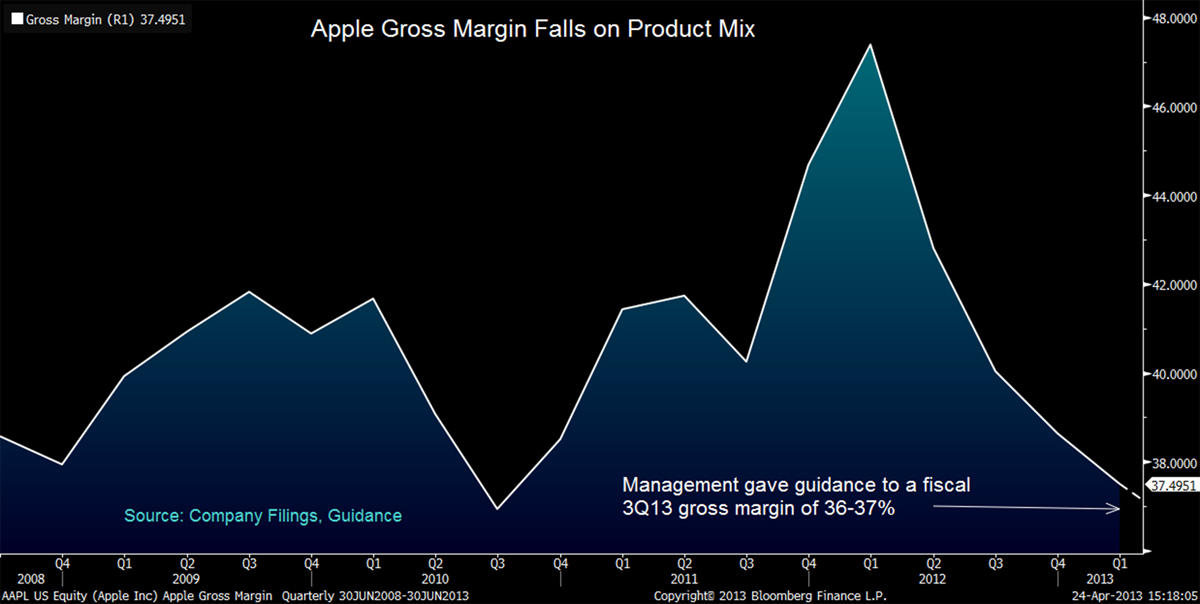

Apple’s continuous stock price depreciation has shareholder’s contemplating about where the stock price could “bottom out.” An onslaught of fundamental data coming from suppliers and consumers signal that further downward pressure could appear for the equity. Apple issued 2013 fiscal 3Q gross margin guidance of 36% to 37% below its 2Q margin of 37.5% due to lower sales of high-margin iPhones and a decline in volume manufacturing efficiencies. iPhone segment gross margins may fall as customers increasingly purchase a larger proportion of lower priced models.

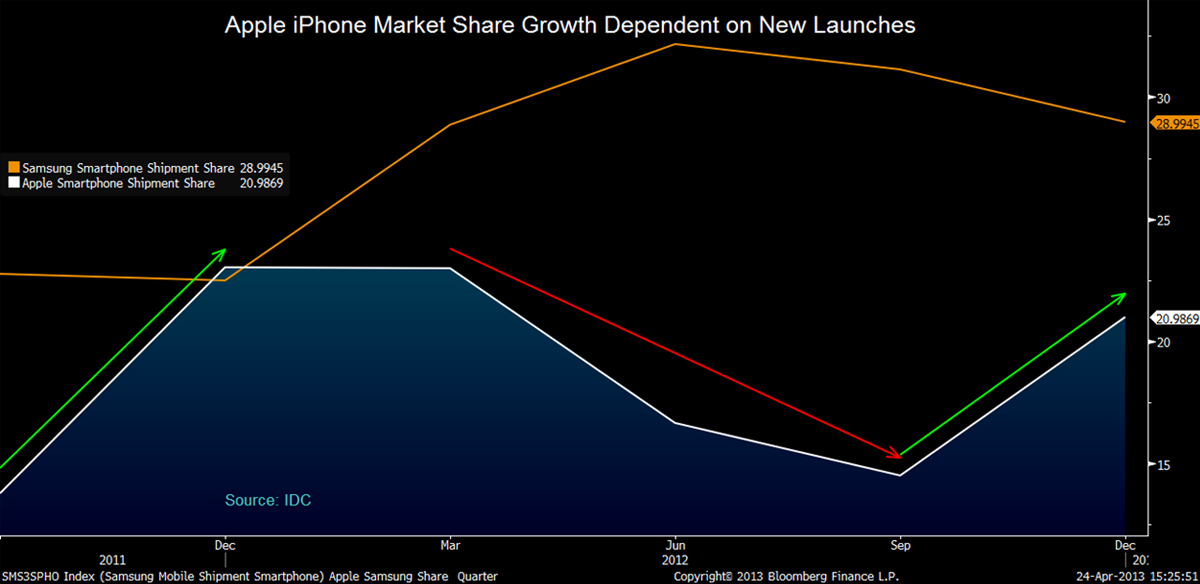

Apple plans to release new hardware, software, and services during the2013 fall season and throughout 2014; including product refreshes and devices in new categories. Apple’s potential new product categories include a watch and a TV. Management has commented in the most recent conference call that the earliest iPhone refresh may come in September. This could mean potential “catch-up” time for wireless phone manufacturers such as Samsung, HTC, and Nokia.

Source: Bloomberg

Article submitted by the Capital Markets Lab (CML). To learn more about the Capital Markets Lab (CML) please visit https://business.fiu.edu/capital-markets-lab/.