Weekly Information Center

Market Insight

Economic indicators continue to progress as the Bureau of Labor Statistics reports an improvement in the economy’s unemployment rate to 7.0%, down from a previous reading of 7.3%.

Among the continuing economic development of the nation, initial claims has seen a steady decrease from previous quarters, declining to 298k, from a 321k and 344k reading in November and October respectively. In addition, personal spending continues to improve at a moderate rate of .8% for the month of October, up from a previous reading of -.3% for September. Overall economic progress has yielded a consensus GDP growth forecast of 3.6% for the third quarter of 2013, making this quarter the strongest of the year. While leading economic indicators have progressed, headwinds remain for the Federal Reserve’s tapering, namely falling inflation and market volatility due to the fiscal cliff. As a result, it is important that investors remain aware that the Federal Reserve may have the economic data necessary to begin the cut-back of the bond-purchases within the next quarters.

Weekly Review

- Initial claims decreased to 298k, down from 321k in previous reading

- Personal spending ticked higher in October to.3%

- Unemployment rate continues its trend downward, reaching 7.0%, from a previous reading of 7.3%

- Second GDP forecasts a 3.6% growth for Q3

- Nonfarm payrolls advanced 203k, up from a previous reading of 200k

- Consumer sentiment increased to 82.5 in December, up from 75.1 in previous quarter

What to look for in the Week Ahead

- Core PPI

- Inventories

- Treasury Budget

- Retail sales

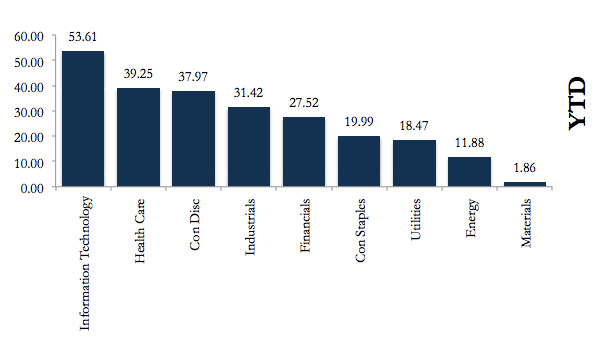

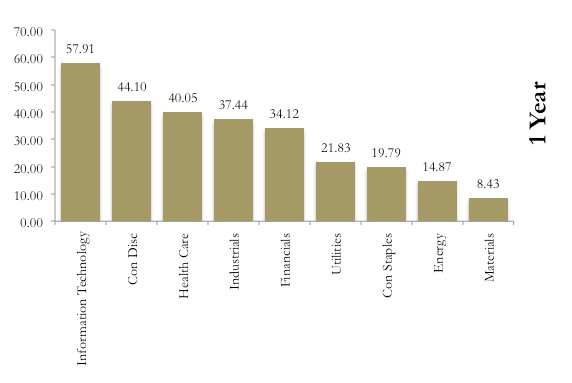

S&P 500 Sector Performance