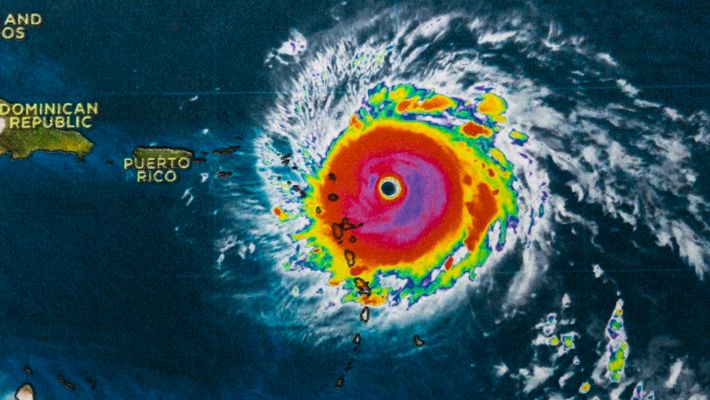

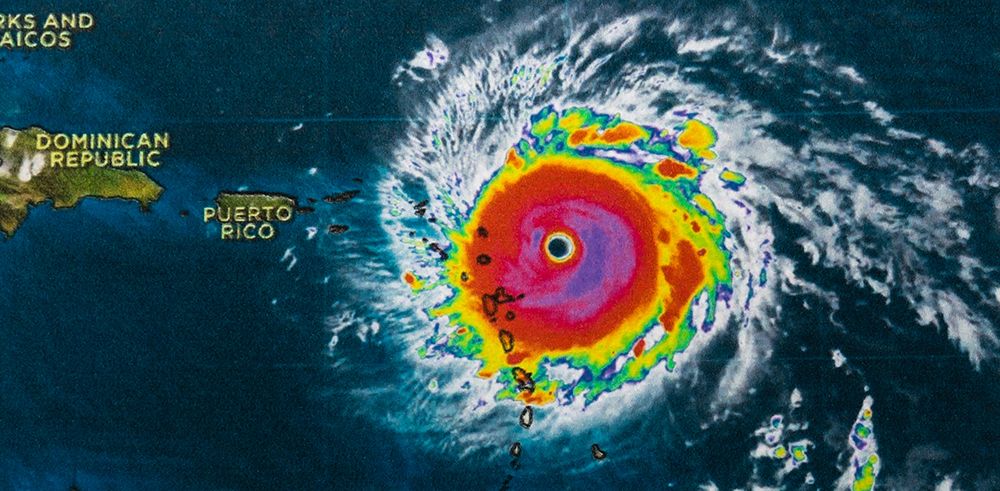

The FIU-led Florida Public Hurricane Loss Model (FPHLM), a joint project with four other universities, was recertified by the State of Florida for the next two years. The innovative FPHLM is used to calculate the financial and insurance impact of hurricanes.

It is the State of Florida’s benchmark for evaluating the financial risks faced by insurance companies that write windstorm policies, and, in turn, set the premiums paid by their customers.

“The Florida Public Hurricane Loss Model has turned out to be a very useful tool for the State and private companies,” said Shahid Hamid, chair of FIU College of Business’ Department of Finance and director of the Laboratory for Insurance, Financial & Economic Research, part of FIU’s Extreme Events Institute (EEI).

The FPHLM’s computer programs simulate and predict how a hurricane will interact with different types of structures and how much damage it will cause to roofs, windows, doors, and interiors. It also estimates how much it will cost to rebuild from the damage and how much will be paid by insurers.

“It has been used over 1,100 times by the State of Florida to evaluate insurance company rate filings for setting premiums, to assess hurricane risk to the buildings in Florida, and to help determine premium discounts and credits for mitigation,” Hamid added. “It has been used to conduct annual stress tests on over 60 insurance companies to help determine their solvency in case of disaster.”

Hamid’s team includes specialists in meteorology, storm surge, hydrology, engineering, finance and actuarial science, computer science and statistics from FIU as well as the University of Florida, Florida State University, Florida Institute of Technology, University of Miami and the National Oceanic and Atmospheric Administration.