Market Insight

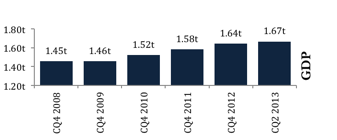

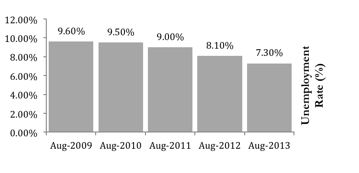

Corporate profits reach all-time nominal high in Q2 increasing to a 12.53% of GDP output from a 12.22% in the previous quarter. In addition, with the close of Q3 last week, performance of the Fortune 500 points to yet another strong quarter for large cap equities. However, despite the record-setting profits, the government shut down last week has affected consumer and investor sentiment, alluding to potentially higher volatility looming ahead. The disruption as a result of fiscal drag and the stalemate in Washington points to the seemingly policy-dependent market movements, which can further disrupt the markets in the short-term. With the growth in nominal GDP steadily rising, the decline in unemployment, and the steady increase in corporate profits reveals to a continuing recovery from 2008. Investors should continue to price economic and company fundamentals.

Weekly Review

- Chicago PMI and ISM Index points to acceleration in manufacturing, edging higher to 55.7 and 56.2, and increase from 53.7 and 55.0, respectively.

- Unemployment rate was not released in light of the government shutdown. Nevertheless, ADP reported an increase in private sector payrolls of 166,000, while the initial claims increased to 308,000. The rate of unemployment has steadily declined since 2009.

What to look for next Week

- U.S debt-ceiling

- Earnings season

- PPI Index

Economic Fundamentals

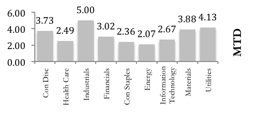

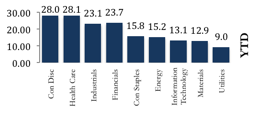

Sector Performance

Article submitted by: J. Camilo Parra of the Capital Markets Lab (CML). To learn more about the Capital Markets Lab (CML) please visit https://business.fiu.edu/capital-markets-lab/.